Letter To Waive Penalty Charge | (state how you would like to make amends. If you provided supporting documentation and it's not enough to correct penalties and fees, you can dispute the penalties and fees. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. Will the irs waive an fbar penalty? The details of the punishment the sender hopes to waive due to late payment should also be provided.

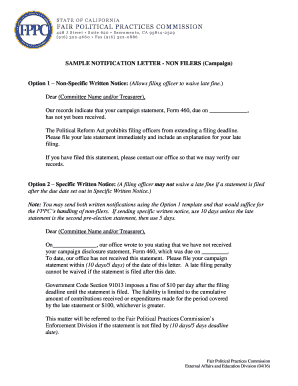

Ftb penalty abatement letter exampleshow all. This is my first time delay payment, please help confirm by return. Information on penalty and interest charges for late filing of a tax return and/or late. Dear sir/madam, i wrote this letter to request to waive my penalty for the late rental fee. Will the irs waive an fbar penalty?

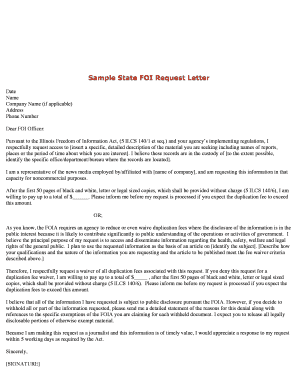

Sample a sample of application letter for noc, how to write a letter to waive penalty charges for credit card?. For instance, you may be given a citation, a penalty fee, or a new financial obligation. Letter format rmd penalty waiver request sample pennsylvania day. It may be something unfair that is inconsequential or something that is big and could change everything! The minister may grant relief from penalty or interest when the following types of situations prevent a taxpayer from meeting their tax obligations This letter is a reminder to you that. Sample letter to waive penalty charges for office rental. Written by frederick schmitt a waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. To request that a tax penalty be waived, the taxpayer would be required to write a penalty abatement letter to the irs to make this request. Request to waive penalty letter details: Tax corresponder cfs tax software inc software for tax. I do respect the legal rights of the bank to charge for a delay in payment but this has been a result of the adverse circumstances i am facing. Download free sample letter request to waive penalty charges pope.

Sample letter to waive penalty charges for office rental. Sample letter request waive penalty charge will orange county california waive penalty. In most cases, nothing can really be done about it. Letter of waiver of penalty sample. For instance, you may be given a citation, a penalty fee, or a new financial obligation.

Kra tax penalty is a fine charged based on the failure of a person to file his or her annual returns, or failing to pay taxes. Request letter for insurance penalty charges waiver… letter requesting to waive off late payment charges. But what is a waiver of penalty letter? I do respect the legal rights of the bank to charge for a delay in payment but this has been a result of the adverse circumstances i am facing. Letter of waiver of penalty sample. Information about making a request to the cra to cancel or waive penalties or interest. Ftb penalty abatement letter exampleshow all. Education degrees, courses structure, learning courses. Use tax write off sample letter to request unassessed accuracy related. Www.xmediapartners.com › … › letter sample letter waiver of early settlement penalty charge. Request to waive penalty letter details: For instance, you may be given a citation, a penalty fee, or a new financial obligation. If you disagree with a penalty or think there was a mistake, use the options listed on your letter.

Kra waiver letter is a document/letter address to kra stating the reasons why you need the penalties imposed on you for late filing of returns to be removed or simple terms waived. A request letter to waive bank fees is written by the customer of a bank to bank authorities requesting them to waive the bank fees for various reasons, as may be i was recently intimated via mail that a sum of 15000 francs had been charged for money transfers and other miscellaneous services. I wrote this letter to request to waive my penalty for the late rental fee. These things cause serious issues like paying the fine to the government. Sample letter request waive penalty charge will orange county california waive penalty.

I do respect the legal rights of the bank to charge for a delay in payment but this has been a result of the adverse circumstances i am facing. For instance, you may be given a citation, a penalty fee, or a new financial obligation. Interest is charged by law and. Use tax write off sample letter to request unassessed accuracy related. Ird request to waive penalty sample letters to waive a penalty penalty waiver request letter sample request waiver of penalty letter. Letter of waiver of penalty sample. If you provided supporting documentation and it's not enough to correct penalties and fees, you can dispute the penalties and fees. In most cases, nothing can really be done about it. To request that a tax penalty be waived, the taxpayer would be required to write a penalty abatement letter to the irs to make this request. Please help to waive penalty for usd200.00 (usd100.00 late charge and usd100.00 finance charge). Written by frederick schmitt a waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. Sample letter to waive penalty charges for office rental. How to write a letter to waive fees sample letter of waiving.

Letter To Waive Penalty Charge: If you provided supporting documentation and it's not enough to correct penalties and fees, you can dispute the penalties and fees.